New Year, New Newsletter

Updates about Creative Ventures and our New Thesis

It’s not quite the new year yet, but we’re getting there! This is a welcome post announcing that we’ve moved our newsletter to Substack.

We’re hoping to cover more news about us here, but also continue providing interesting insights about the venture market at a more frequent basis again.

Global Recognition for Creative

RAISE Global Summit and All Raise

Over 900 GPs applied for a spot on the main stage of RAISE.

There were only 24 spots.

And Creative got one—in particular, our partner Kulika Weizman! With professional VC investors like Cambridge Associates, Fairview Partners, and Makena Capital on the selection committee, we’re excited to have been showcased at such an amazing venue.

Thought Leadership (and a book!)

Speaking of selection, our partner James was selected—out of thousands of proposals—to chair a panel on AI startups at SXSW 2025. Reach out if you’ll be in town then.

Additionally, his popular AI Substack, Weighty Thoughts continues to grow.

And perhaps most excitingly, he’s writing a book! It is due to the publisher on December 6th and targeting a Fall 2025 publication. Follow his progress here!

Our New Investment Focus

Many of you attended our LP Summit last month where we announced our new investment focus. It’s more of a refinement than a complete overhaul, but we’re very excited about it.

Since our founding in 2016, we have talked about the potential of AI and compute for the world. At this point, it’s become one of the most hyped areas of VC. However, we think the most important areas are still being neglected, in favor of flashier areas like “foundational models” (James has written extensively about why we don’t think they’ll realize the returns everyone is hoping for—like the economic model, competition from open-weight models, or even just the valuations).

We’ll be publishing newsletters in the coming months about our new thesis more, but the point is we’re interested in what will impact humans the most. That’s why we’ve adopted a new tagline of humanizing deep tech.

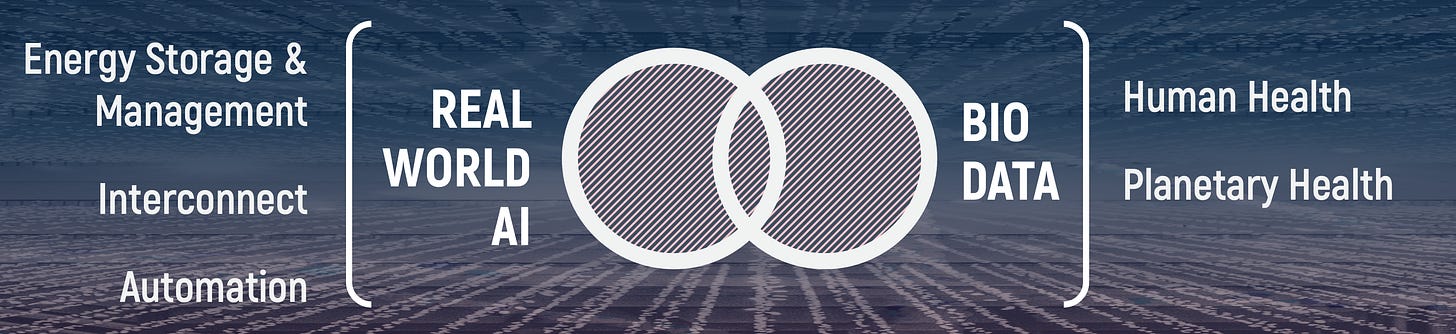

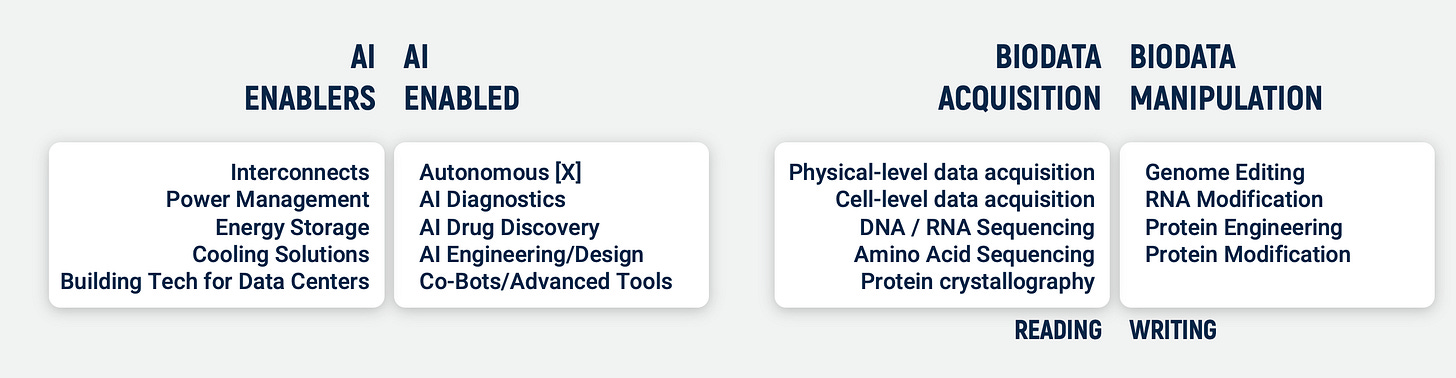

We’re looking for investments that: 1) enable AI (picks and shovels) + are enabled by AI (real world, embodied applications—and not just LLMs), and 2) biodata acquisition and biodata manipulation (which touches AI for things like drug discovery, but is also fundamental physical biology that will change the way we live).

We’ve already been doing these investments for years, but moving forward we’re reemphasizing the importance of these investments in our portfolio—and in a way, are entirely refreshing the way we do things.

Stay tuned as we update you all here, and thank you all for sticking with us on this journey!